Home »

Assessment Ruleset overview

In Nimo we refer to an Assessment ruleset as an “Assessment Pipeline” as it combines and treats both manual and digital information within one ruleset.

The Assessment tab generates an assessment pipeline that incorporates the credit guidelines and policies specified by the lenders.

After the pipeline rule set is established, it is linked to the relevant Products.

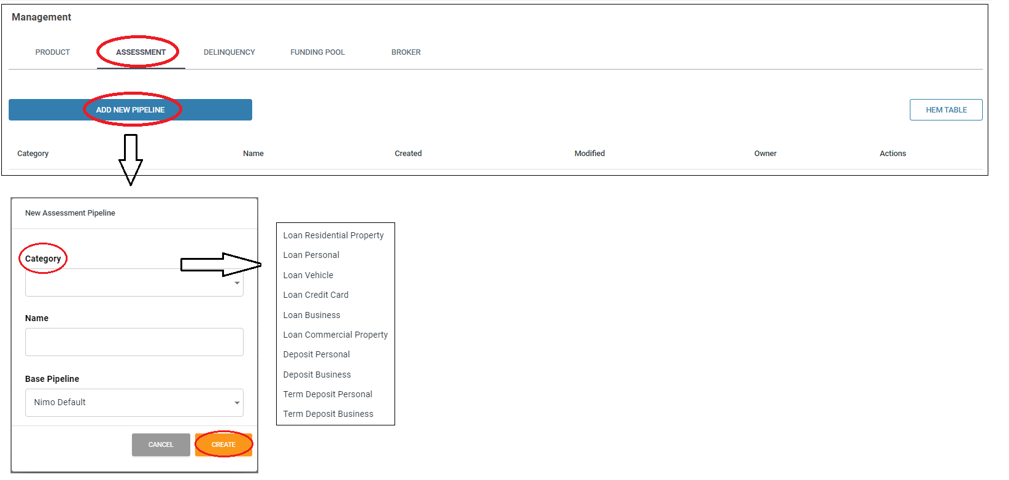

To create a new pipeline, click on “Add New Pipeline” and a pop-up will appear allowing you to select the assessment category from a drop-down menu. Lastly, give the pipeline a name.

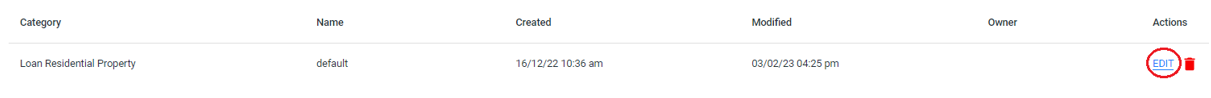

Once you have saved the Assessment pipeline, it will be visible on the main screen within the Assessment tab. If changes are necessary, click “Edit” which can be found on the far-right side of the specific Assessment pipeline.

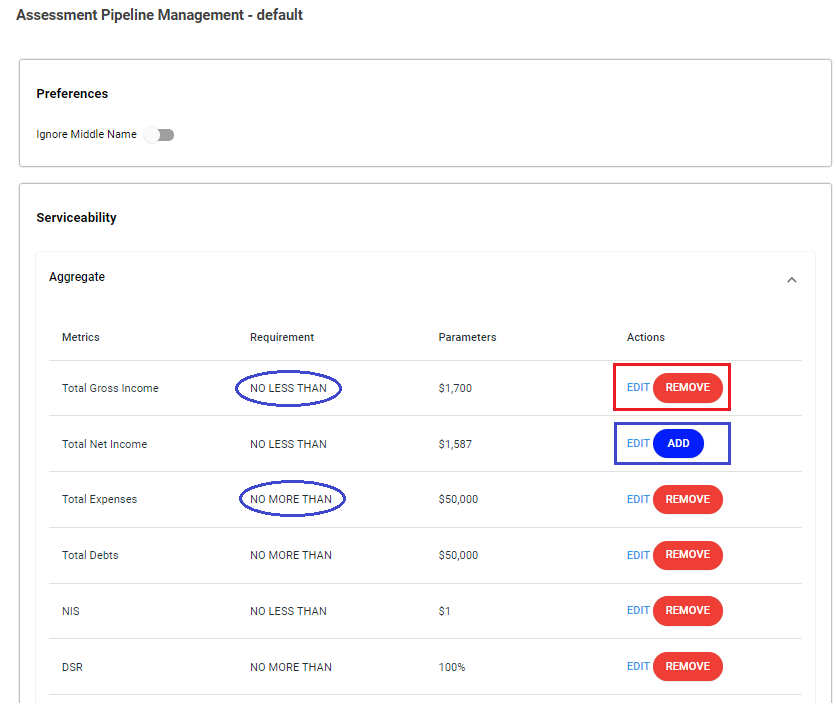

By clicking the “Edit” link, you will be redirected to the Assessment Pipeline Management screen where you can modify your credit guidelines and policies. The rule sets are organized into four categories:

- Serviceability

- Asset Position

- Character

- Condition

Within the Assessment pipelines you can delete or include as many questions as you like. If you would like to add specific ones, let us know and we will understand if we manage the same rule in a different way, or make a rule for you if necessary.

Each rule is made from a list of ‘Parameters’ that relate back to the manual information provided relate back to the in the Application stage and the treatment of digital data.

So parameter enable all values to be ‘Accepted’ or ‘Referred’ when they do not match up to the rule. For example the stage that the data is collected is usually Application (unless a credit check, valuation or land title, and the stage where the rule is applied to the data is in Assessment.

Definitions of the ruleset treatment:

Equals = exact. For example “Peter Jones” does not equal “Sam A James”

No less than = The value must be more than the rule value

No more than = The vlaue must be less than the rule value

In = A value within a data range that is added into Assessment rule (normally a list)

Not in = A value within a data range that is added into Assessment rule (i.e If property Postcode is in the range it will refer) (normally a list)

Require = A document is required (i.e a PDF of a Land title, Valuation, Credit Bureau report etc)

Serviceability Subcategory

Aggregate:

Total Gross Income – The combined gross income of all sources. (Before tax)

Total Net Income – The combined net income (After tax)

Total Expenses – The total expenses incurred, after credit guidelines have been applied.

Total Debts – The combined debt balances and credit limits owed by the customer.

NIS – The minimum surplus required each month.

DSR – Debt to Service Ratio is calculated by Net Income / Total Debt = DSR

LTI (Gross Income) – Loan-to-Income ratio calculated by dividing the application loan amount applied for by the total income.

DTI (Gross Income) – Debt-to-Income ratio calculated by dividing Total Debts by Total Income.

Credit & Store Card Expense:

Expense Amount – Repayment retrieved from the bank statement.

Liability Amount – Current balance of the credit/store card.

Liability Limit – credit/store card credit limit

Liability Limit % – the percentage used to calculate the repayments as per company credit polices (use provided calculator to work out the percentage from a repayment (limit, term and set interest rate)

Adjusted Expense – the result of the repayment once the company credit policy rule is applied (percentage etc)

Bank Statements of Loan – this is request to a copy of the bank statement of the credit card.

Income Employment:

Job Type – PAYG. Self Employed, Unemployed, Retired

Job Basis – Full Time, Part Time, Contracts, Casual etc.

Latest Job Commencement – the date you started your previous job.

Base Gross Income – Income before tax

Base Net Income – income after tax

Additional Gross Income – income before tax for other sources e.g., rent.

Additional Net Income – income after tax for other sources e.g., rent.

Additional % – allowable percentage to use of additional income as per company credit policy.

Additional % Gross Income – income before tax result after company credit policy percentage is applied.

Additional % Net Income – income after tax result after company credit policy percentage is applied.

Total Net Income from Bank Statement – actual after-tax income retrieved from the bank statement.

Total Net Income Verified – manual verification of after-tax income.

Documents:

3 Months Payslips – requested months of payslips for customer to upload.

3 Months Income Bank Statement – requested amount of last x months bank statement to verify income against the 3-month payslips.

2 Years Financials – Company tax returns and financials including balance sheets to be uploaded.

2 Years Tax Returns (Business) – appliable to self-employment to confirm business operating income and solvency – to be uploaded.

2 Years Tax Returns (Individual) – Used for income verification when a customer has a private tenancy agreement, and rental income needs to be confirmed. Alternatively, it can also be used when a customer is a contractor working for multiple companies and income verification is required. The customer is required to upload their 2-year tax returns.

Income Other:

Income Type – Interest earned, investment income (rent) superannuation etc.

Total Income – total income from the second job

Additional % – allowable percentage to use of additional income as per company credit policy.

Additional % Other Income – income before tax result after company credit policy percentage is applied.

3 Months Income Bank Statement – this is request to a copy of the bank statement to verify income via the physical bank statements cross referenced with the payslips.

Living Expense:

19 Living Expense

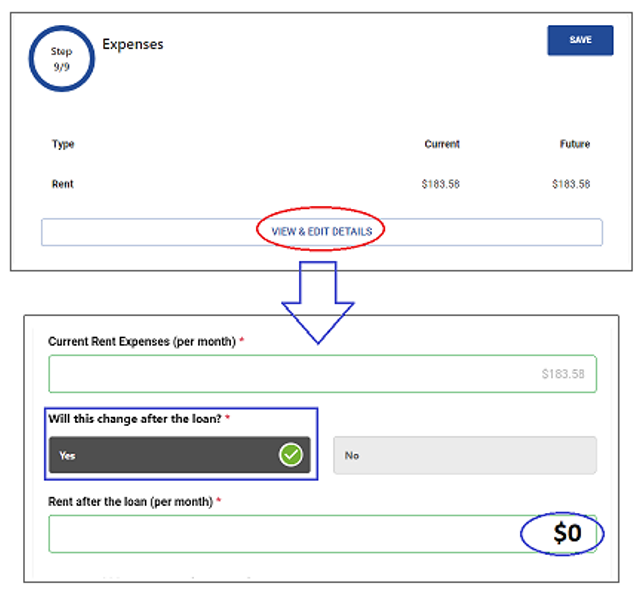

During the loan application process, NIMO obtains the customer’s transactional data from their internet banking and verifies it against what they declared will happen after settlement. If the customer indicates that a cost will decrease or disappear after loan settlement, the Assessment pipeline rule will compare it to the data retrieved from their internet banking.

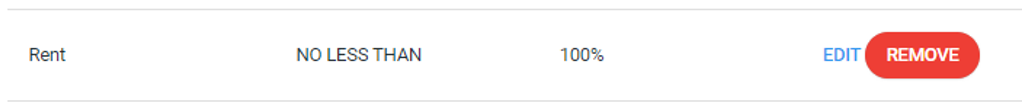

The Assessment rule displays that the rent must not be “Less than” 100% of the data retrieved from the internet banking, or else the loan application will be referred to the Credit Management team for further evaluation.

For instance, the figure below demonstrates a scenario where the customer’s rent has been retrieved from their internet banking at $183.58 per month. However, the customer selected “Yes” and entered a new value of $0, indicating that they no longer need to pay rent because they have purchased a new property however this will refer due to the rule being anything Less than 100% of the initial value ($183.58) will refer to the credit team to review.

Loan Expense

Expense Amount – Repayment retrieved from the bank statement.

Liability Amount – loan amount retrieved from the customer application form.

Evaluation Percentage – percentage of the Repayment amount to be used retrieved from the bank statement.

Repayment Amount with Buffer – Repayment of the loan, including an added base buffer (e.g., a 4% advertised interest rate plus a 3% base buffer results in a repayment calculation of 7%).

Repayment Amount with Interest Floor – Repayments are calculated based on the higher of the base buffer rate or the interest floor rate. (e.g., if the combined advertised and base buffer rate is 4.5% and the interest floor rate is 5%, the repayments would be based on the interest floor rate as it is higher).

Bank Statements of Loan – this is request to a copy of the bank statement of the loan.

Preference

Period of Time – The frequency the lender decides the assessment pipeline income should be calculated as either monthly or annual basis.

Asset Position Subcategory

Aggregate

Total Net Assets – total combined asset values after liabilities are deducted.

Combined Assets Amount – combined Asset values

Combined Liabilities Amount- combined Liabilities values

Security Property Value – Valuation of the property used to secure your loan against

Other Assets Amount – e.g., shares

Asset/Liability Ratio – Asset amount / Liability = Ratio

Deposit Fund

Customer Estimate Value – declared funds customer has advised they have available.

Verified Deposit Value – confirmed funds customer has verified via bank statements etc.

Institution – Name of the Financial Institution

BSB

Account Number

Evaluation Percentage – percentage of deposit allowable to use towards loan.

Asset – Home Content

Customer Estimate Value – customer declared.

Market Value – value verified.

Evaluation Percentage – percentage of home contents allowable to use towards loan.

Proof of Asset – evidence of asset.

Asset – Other

Customer Estimate Value – customer declared.

Market Value – value verified.

Evaluation Percentage – percentage of home contents allowable to use towards loan.

Proof of Asset – evidence of asset.

Asset – Property

Is Primary Property – this the asset your primary residence.

Property Size (in square meters) – this would apply to apartments/units.

Land Area (in square meters) – property land area (farms etc.)

Accepted Property Type – acceptable company credit policy security types allowable.

Accepted Purpose – the purpose of what the loan is being used for to be acceptable as per company credit policy.

LVR – loan to value ratio – total loan amount / total valuations of all securities.

Customer Estimate Value – customer perceived estimate on what the property is worth.

Market Value – Value obtained via valuation completed by valuer.

High Risk Postcode – Post codes the company credit policy does not wish to lend too.

High Density Postcode – normally refers to apartments or strata titles with many complexes.

Land Title – Title of the property.

Land Title Encumbrances – displays the number of interests against the property (e.g., a bank has an Encumbrances/interest against a property listed on the title of the property as they have provided the customer a loan. (If a homeowner doesn’t keep up with mortgage payments, the lender has the right to foreclose on the property)

Land Title Name – name on the title (normally confirms the property owner ownership)

Land Title Type – Torrens (most common), Strata title, Leasehold, Company

Land Title Tenancy – Tenancy in common is a popular type of property ownership that means two or more people co-own property in defined shares. The shares owned in a tenancy in common can be equal or unequal. For example, you can own 99% of the shares, and your co-owner can own 1%

Proof of Land Title – evidence of the land title

Property Valuation – displays if the property has been valued.

FSD Confidence – The lower the FSD, the better quality/accuracy of the AVM. This percentage is sometimes turned into a confidence score by subtracting it from 100 percent (e.g., an FSD of 0.07 or 7 percent is a confidence score of 93 percent).

Proof of Valuation – valuation report provided by the valuer.

Asset – Share

Customer Estimate Value – the value of the stock portfolio the customer perceives it to be

Market Value – current value of the stock portfolio as per the current market trading value.

Evaluation Percentage – percentage of home contents allowable to use towards the asset position.

Share Certificate – evidence of the stock portfolio.

Asset – Superannuation

Superannuation Fund Value – Funds currently within the superannuation account.

Proof of Asset – evidence via statement.

Evaluation Percentage – percentage of home contents allowable to use towards the asset position.

Asset – Vehicle

Age – age of the vehicle

Customer Estimate Value – customer declared perceived value of the vehicle.

Market Value – actual value of the car on the market

Evaluation Percentage – percentage of home contents allowable to use towards the asset position.

Proof of Registration – registration certificate

Liability – Credit Card

Liability Amount – amount outstanding and owing on the credit card.

Bank Statements of Credit Card – evidence to confirm actual credit card debt.

Liability – Home Loan

Liability Amount – amount outstanding and owing on the home loan.

Bank Statements of Loan – evidence to confirm actual home loan debt.

Liability – Other

Liability Amount – amount outstanding and owing on the liability declared.

Statements of Liability – evidence to confirm actual other liability declared debt.

Liability – Personal Loan

Liability Amount – amount outstanding and owing on the personal loan.

Bank Statements of Loan – evidence to confirm actual personal loan debt.

Liability – Store Card

Liability Amount – amount outstanding and owing on the store card.

Statements of Store Card- evidence to confirm actual store card debt.