Home »

Asset Position tab

This section checks if the information provided by the customers through their application aligns with the company’s established lending guidelines or policies.

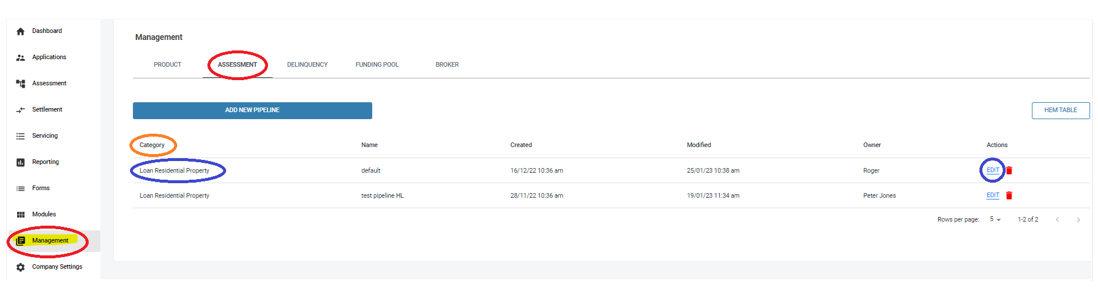

Requirement – refers to the credit guidelines or policy rules. This section can be found in the assessment pipeline for a specific product, which can be accessed by going to the management layer, selecting assessment, then selecting the desired product from the category list and clicking on the “edit” button to add/set/remove rules as per credit policy.

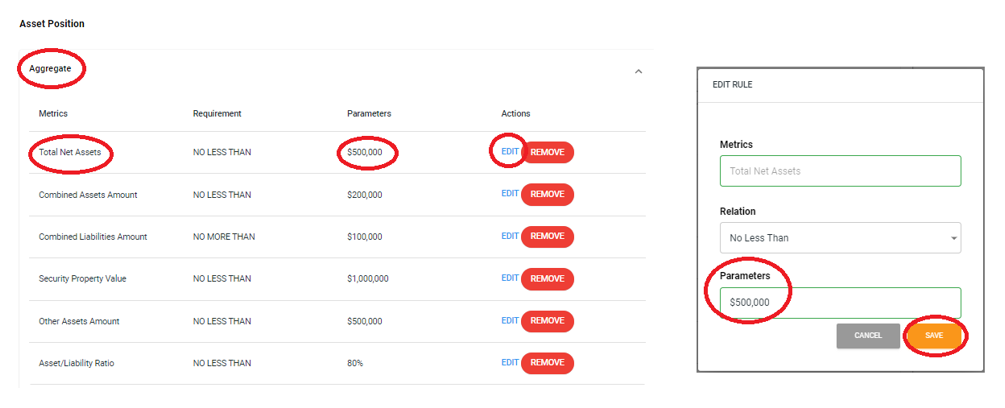

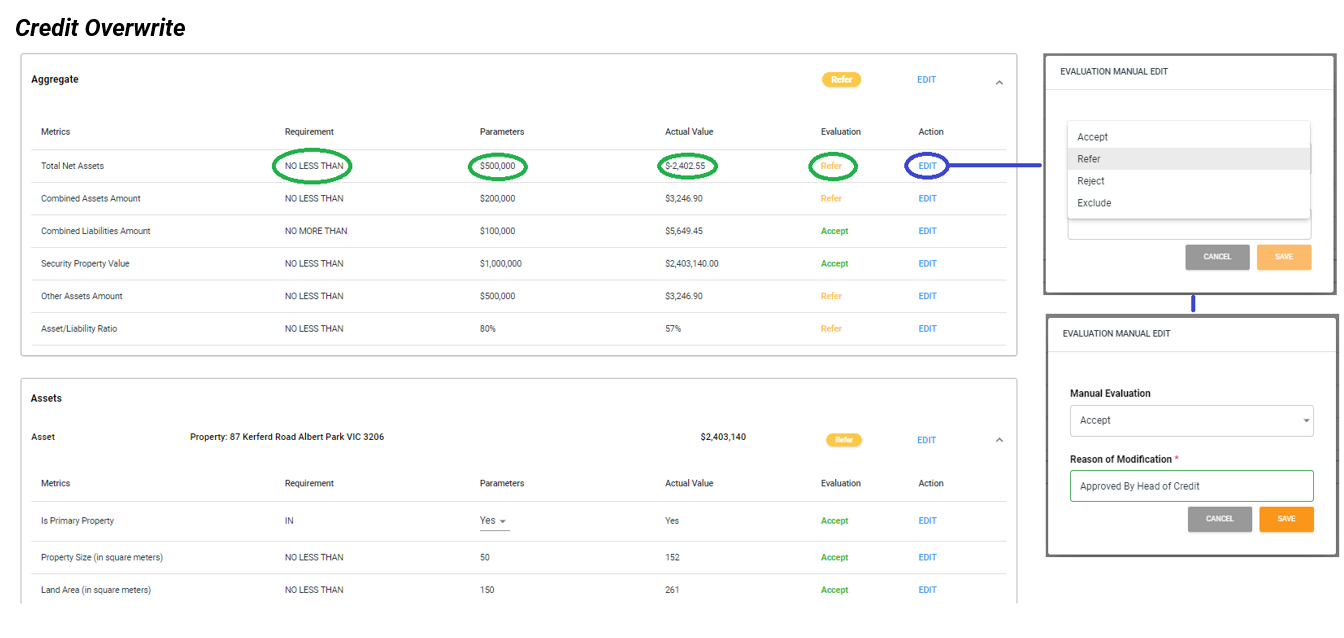

Parameters – refer to the conditions for a rule. For example, the above and below figures show that the net asset position cannot be “LESS THAN” $500,000. If the customer’s net asset position is less than $500,000, then the application is referred or the credit manager with the correct delegation can override the system’s decision to accept, decline, exclude, or refer the application.

Actual Value – refers to the amount of information that is shown, collected, or inputted on the customer application or retrieved via bank statements.

Evaluation – refers to comparing the set guidelines or policy rules against the actual amount and determining whether the amount is within the guidelines or policy rules or not, and outputting either an “accept” or “refer” decision. “

Action – refers to the decision made by the credit manager, which can be to “accept,” “decline,” or “exclude” the application. (All assessment rules can be overwritten)