Home »

Loan Contract Upload and Parameterisation

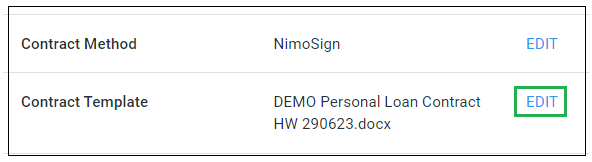

Loan contracts must be in the docx format and NIMO sign selected as the “Contract Method”

Tip:

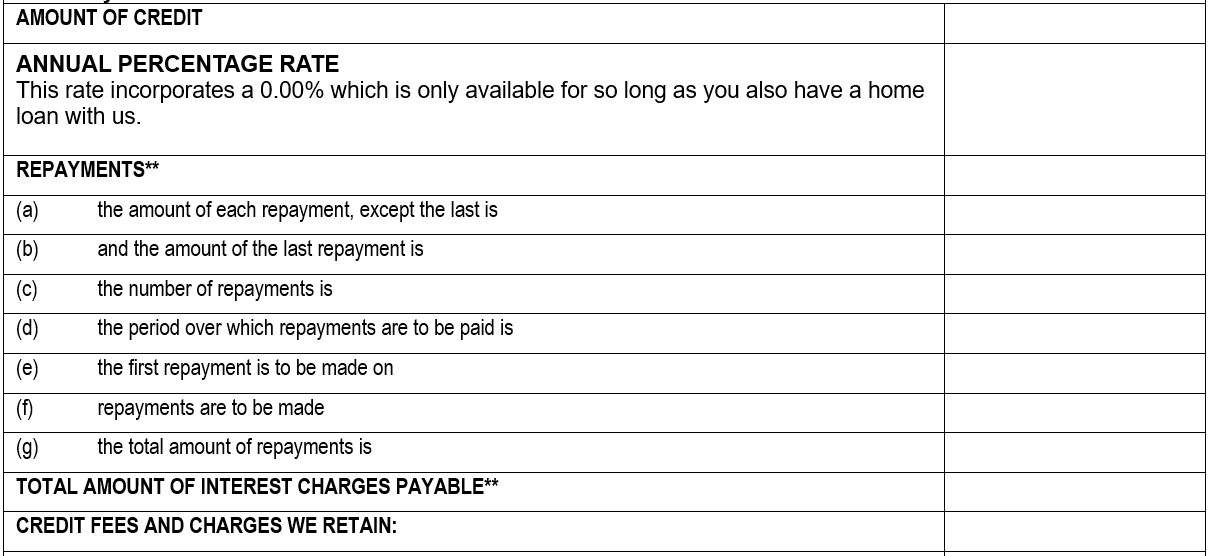

1. Grid layout produces a cleaner output.

2. Do not use symbols, such as ‘.’, in your file names

Whenever you enter one of the parameters, the value will be retrieved from the application and inputted in that section.

To upload a contract, follow these steps:

- Navigate to Management > Product.

- Click “edit” next to the product where you want to load a contract.

- Go to the ‘Contract Template’ label and click “edit.”

- Upload your contract.

Tip: Complete these steps in the UAT testing environment and review the document output.

Grid Layout example

Loan Contracts Parameters

Rules: Dynamic variables needs to be wrapped by {}

|

fullName |

Applicant full name |

BOB JONES |

|

SID |

Nimo application ID |

b8b785f7-4e48-xxx-xxxx-afa617be53bc |

|

address |

Applicant residential address |

|

|

signDate |

Contract signed date (format: DD/MM/YYYY) |

24/10/2022 |

|

dateTimezone |

date with timezone: DD/MM/YYYY z |

29/08/2023 AEST |

|

loanAmount |

Amount of credit to be provided |

$5,000.00 |

|

interestRate |

Interest rate for the term of your Loan Contract |

45.00% |

|

totalInterest |

Total amount of interest charges payable |

$2,612.00 |

|

eachPay |

Amount of each repayment |

$250.00 |

|

totalAmount |

total amount of repayments |

$13,294.56 |

|

loanEstFee |

Establishment fee |

$250.00 |

|

signature |

Applicant Signature (.jpg) |

|

|

repaymentType |

*Repayment type: |

Month |

|

repaymentNumber |

*Number of repayments (loan frequency * loan terms) |

52 |

|

loanLengthInMonths |

Loan Terms in months |

|

|

loanLengthInYears |

Loan Terms in years |

2 |

|

purpose |

Loan purpose |

|

|

totalFeeCharges |

Total credit fees and charges: |

|

|

totalAmountCredit |

Loan amount + Establishment fee + annual fee: {loanAmount} + {loanEstFee} + {annualFee} |

|

|

totalAmountCreditPL |

Loan amount + Establishment fee : {loanAmount} + {loanEstFee} |

|

|

totalAmountCredit |

|

|

|

primaryApplicantCustomerNumber |

customer number (enter from popup) |

|

|

loanNumber |

loan number (enter from popup) |

|

|

loanAccount |

loan account number (enter form popup) |

|

|

vin |

vehicle vin number |

|

|

vehicleModel |

vehicle model |

|

|

vehicleRegistration |

vehicle rego |

|

|

yearManufactured |

year manufactured |

|

|

vehicleMake |

make of vehicle |

|

|

vehicleType |

type of vehicle |

|

|

disbursementIncEstFee |

Loan amount including establishment fee |

|

|

isJointApplication |

is joint application (have 2 applicant) |

|

|

additionalApplicantFullName |

additionalApplicantFullName |

|

|

additionalApplicantSignature |

additionalApplicantSignature |

|

|

additionalApplicantSignDate |

additionalApplicantSignDate |

|

|

additionalApplicantCustomerNumber |

additionalApplicantCustomerNumber |

|

|

totalBorrowerDisbursement |

loan amount |

|

|

brokerCommission |

Broker Upfront Commission Loan Amount+ loan Est Fee−990)× 2 % |

|

|

brokerCommission2

|

disbursementOnlyEstFee x 2% | |

|

brokerCommission1_5

|

disbursementOnlyEstFee x 1.5%

|

|

|

disbursementOnlyEstFee

|

totalBorrowerDisbursement + establishment fee

|

|

|

riskFee

|

value inserted in the other cost field | |

|

insurancesWarranties

|

value from pop up (requires setup) | |

|

dealershipName

|

value from pop up (requires setup) | |

|

totalFeesAndChargesAtSettlement

|

value from pop up (requires setup) | |

|

amountPayableToDealership

|

value from pop up (requires setup) | |

|

commissionPayableToBroker

|

value from pop up (requires setup) | |

|

amountPayableToInsurerProvider

|

value from pop up (requires setup) | |

|

detailsOfInsurancesWarranties

|

value from pop up (requires setup) | |

|

businessName

|

Business Name | |

|

abnAcn

|

ABN or ACN | |

|

businessAddress

|

Business Address | |

|

Lvr

|

||

|

DTI (gross)

|

||

|

Surplus

|

||

|

NdiRatio

|

||

|

Kyc

|

Has KYC been completed successfully | |

|

NeedsAnalysis

|

Is all assessment needs analysis rules ‘Accept’ | |

|

Hem

|

Has HEM been used | |

|

ServiceabilityNotes

|

Assessment change logs – Serviceability | |

|

AssetNotes

|

Assessment change logs – Asset | |

|

ConditionNotes

|

Assessment change logs – Condition | |

|

CharacterNote1

|

Assessment change logs – Character Section 1 | |

|

CharacterNote2

|

Assessment change logs – Character Section 2 | |