Home »

Delinquency overview

Delinquency process is a series of actions taken by a lender when a borrower fails to make payments on a loan or credit obligation. The process is meant to bring the borrower back into compliance with the terms of the loan agreement and to retrieve the debt owed.

Typically, a delinquency process begins with a series of reminders or notifications to the borrower to bring the account current. If the borrower still fails to make payments, the lender may take additional actions, such as charge a late payment fee.

To create anew Delinquency pipeline

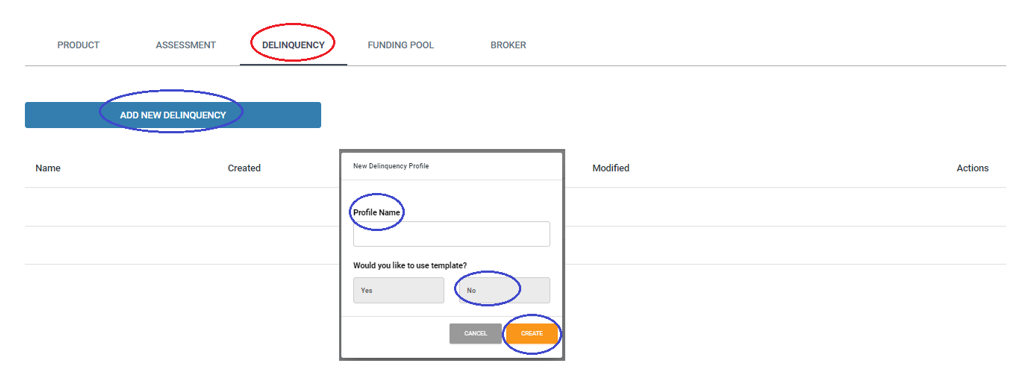

Click on the Delinquency tab.

Click the “Add New Delinquency” button.

A pop-up screen will appear.

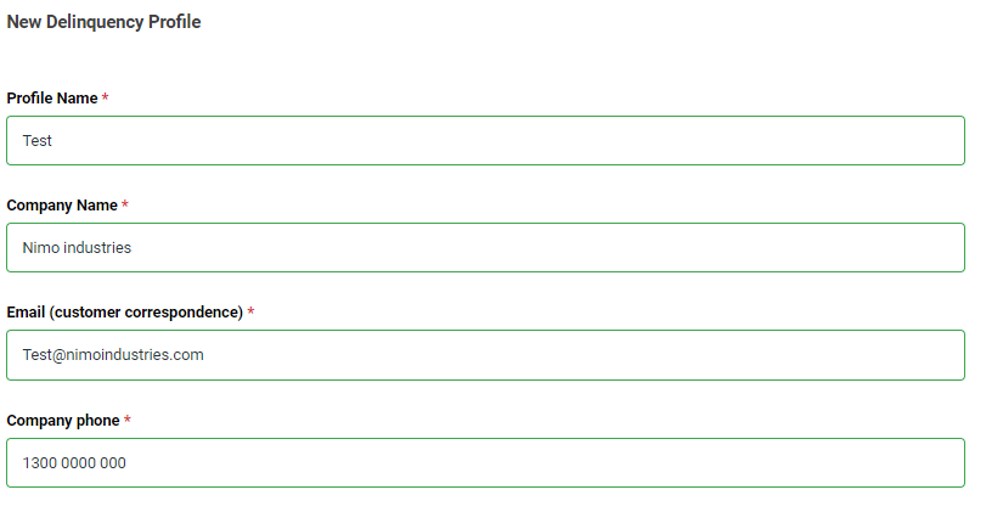

Enter a name for the Delinquency.

Select Yes or No if you wish to use a template (if first time select “No”)

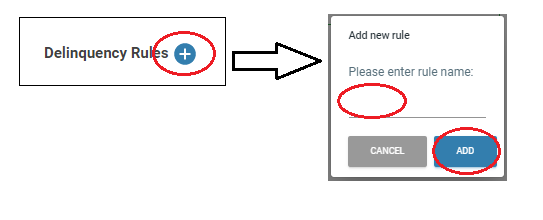

On the Delinquency Profile page, click the “+” button to initiate the addition of a new delinquency rule.

A pop-up window will then appear, allowing you to enter a name for the rule (e.g. Day 1).

After entering the name, click “Add” to complete the process.

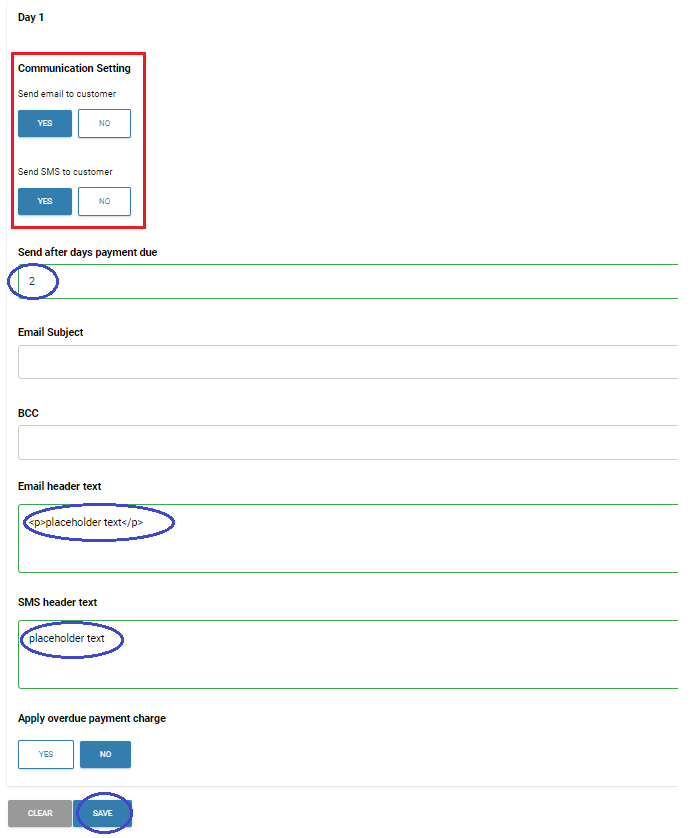

After creating a rule, the following updates are necessary:

- Send an email and/or SMS to the customer

- Specify the number of days after defaulting on a repayment when the delinquency communication will be sent

- BCC: Enter an email address for a copy of the communication to be sent to either the inbox and/or Hubspot

- Email: Input the content of the communication in the email

- SMS: Input the content of the communication in the SMS

- Indicate with YES/NO whether an “overdue” fee will be charged at this stage

Once all the above information has been filled in, click “SAVE” to save the rule.