Home »

Forms overview

The Form builder allows you to create your customer application form.

The application form is organised into modules that can be arranged according to the workflow of the customer’s application form.

Each module within the loan application form represents a page.

In every module, there exist customisable questions that can be tailored to meet your company’s specific requirements. This feature enables you to choose which questions are presented to customers, editing the question wording and also determine which ones are mandatory for customers to respond to before proceeding to the subsequent page.

Here’s how:

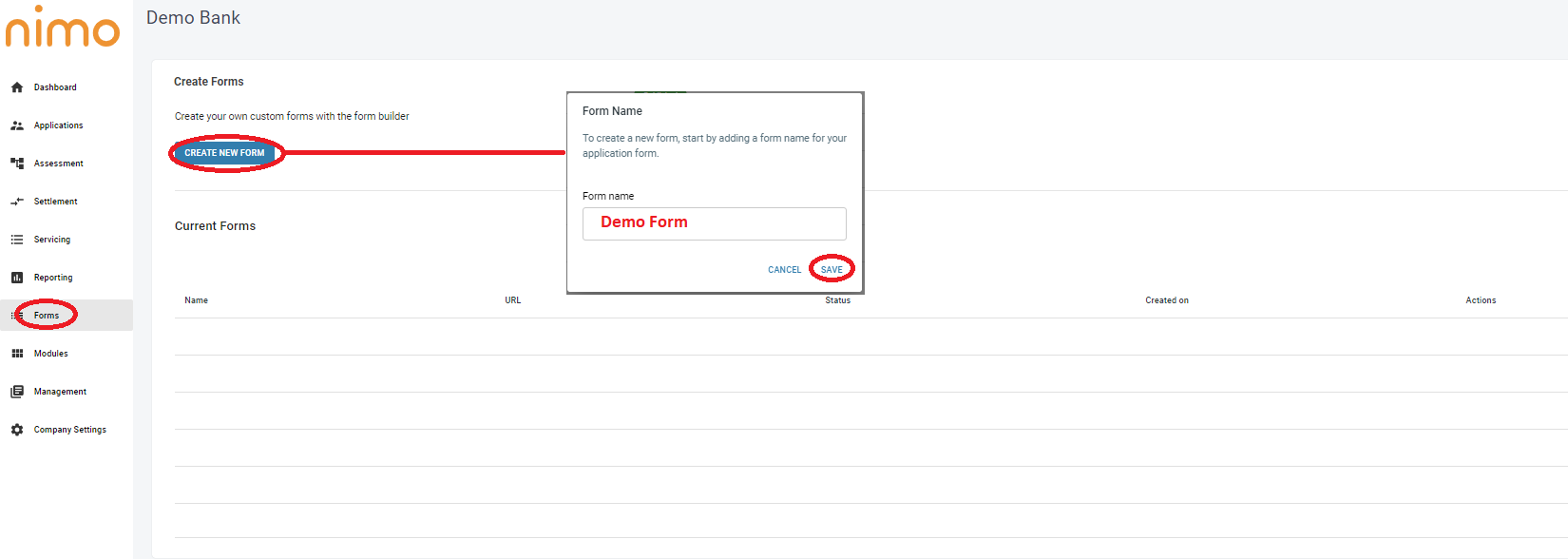

- Click on the “Create New Form” button.

- A pop-up will appear, asking you to name your new form.

- After saving, a new screen will appear for configuring the form.

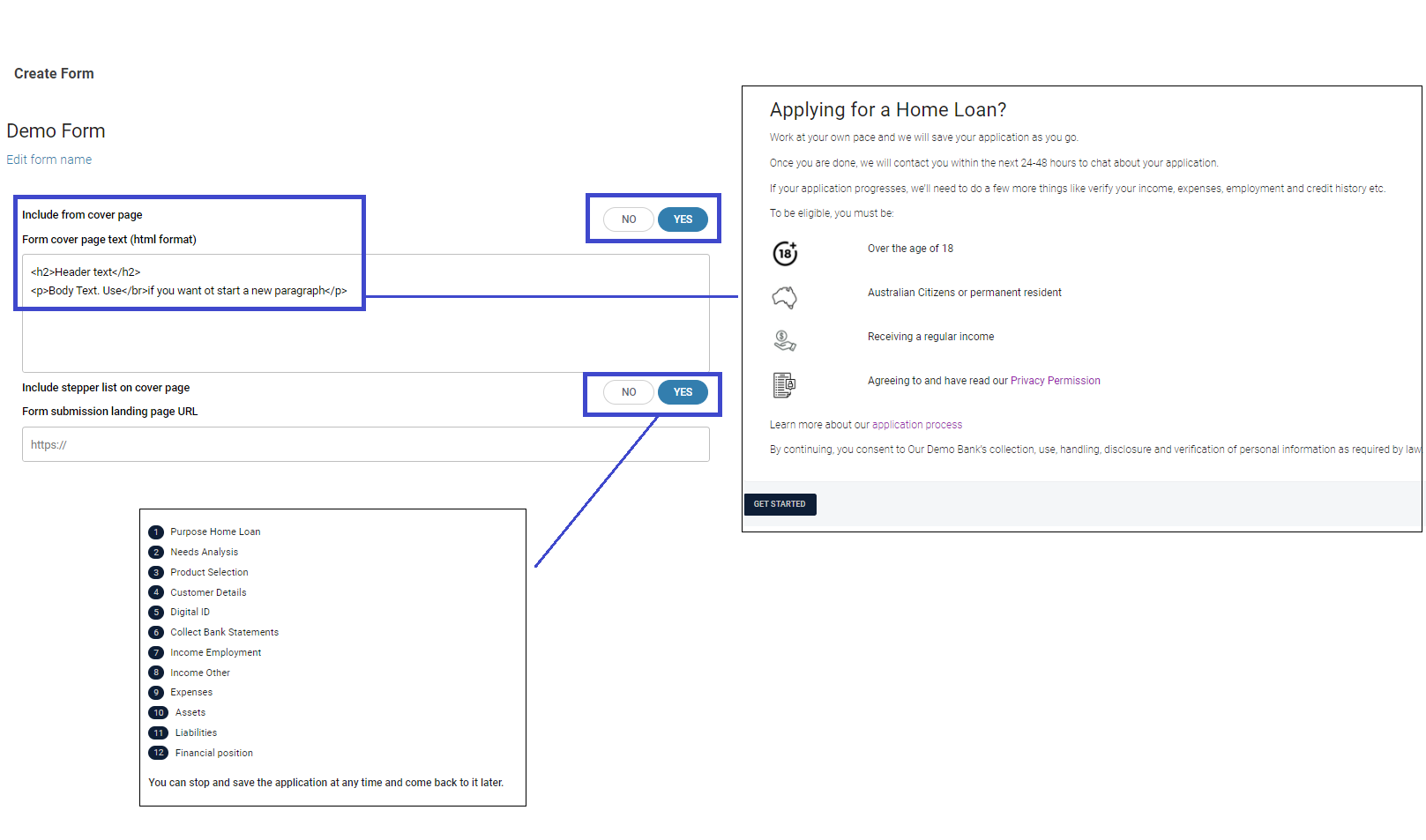

To proceed, you can customise your form by adding a cover page, which is optional.

In the section labelled “Form cover page text,” you can enter the desired text to be displayed on the cover page. An example text has been provided, which you can use or modify according to your company’s needs.

Additionally, you have the option to include a “stepper” that indicates the sections within the application form that require completion.

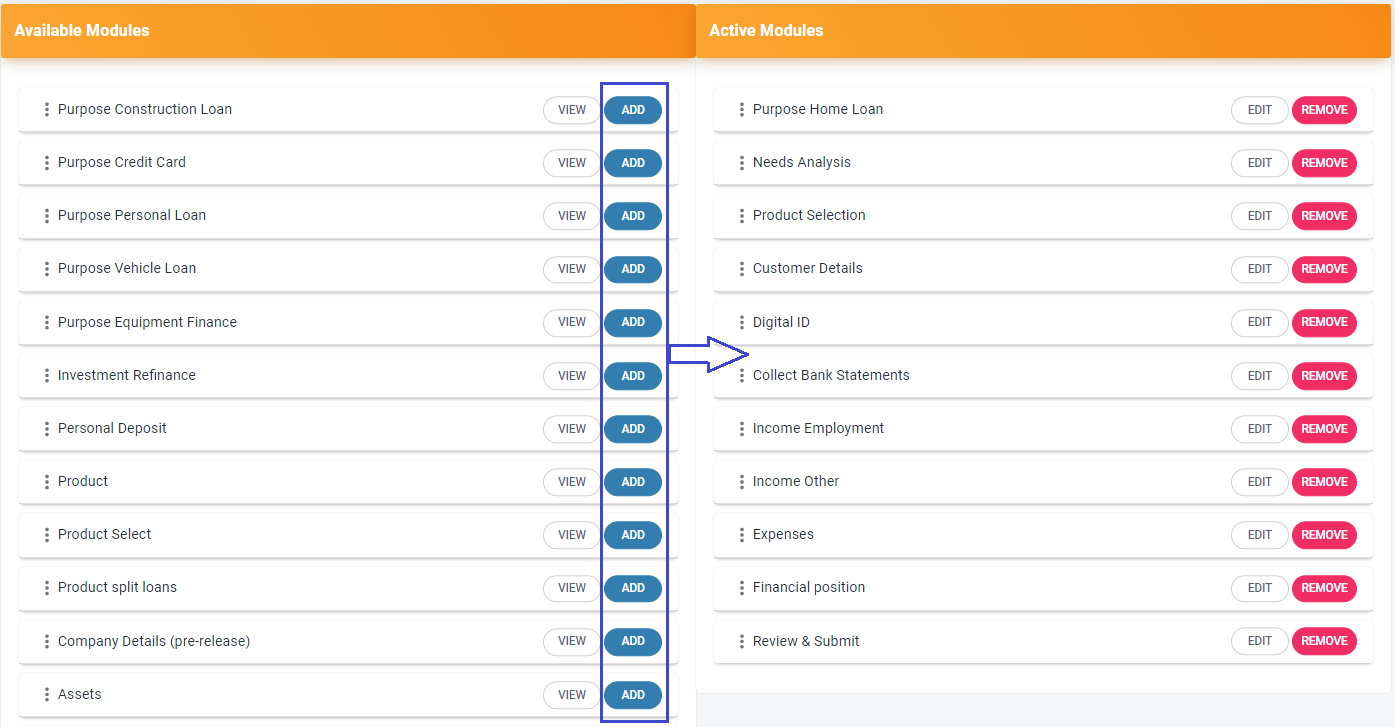

To build out the application, the next step in the process is to include the modules in the form.

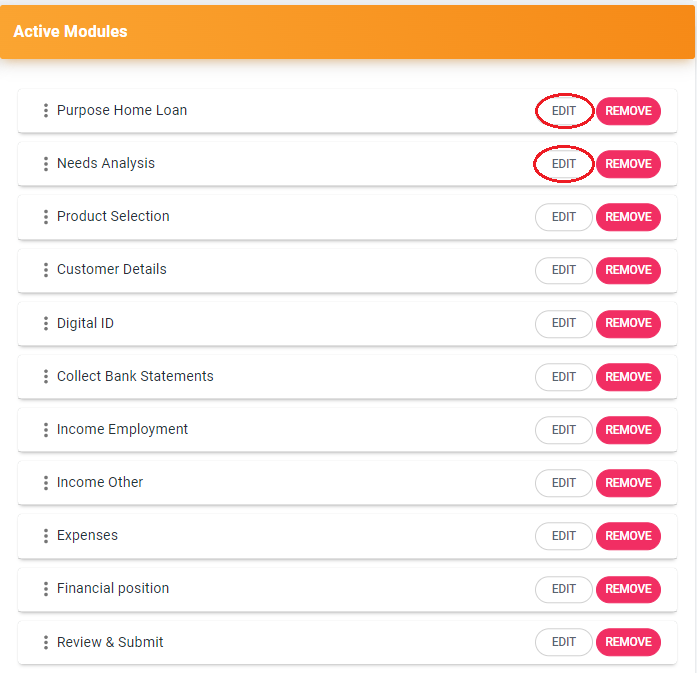

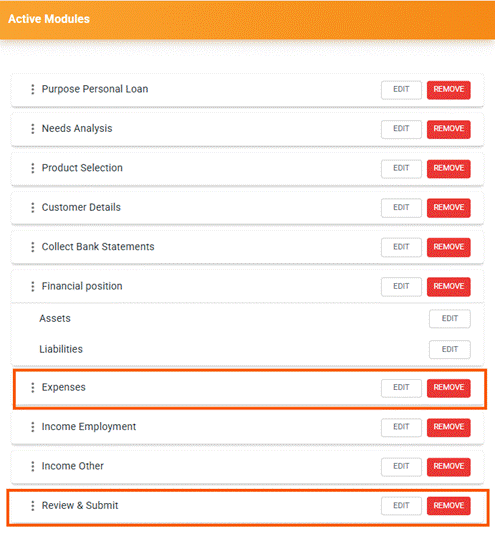

Here is an example of the suggested sequence order of modules for a seamless application flow.

Important note – In order for information from the application form to populate correctly within Nimo, please ensure ‘Review and Submit’ is the last module on customer forms.

Product Selection

The application form is structured such that each module comprises a set of questions that need to be answered.

It is essential to note that some questions may impact the smooth functioning of the application. For instance, the product selection module displays all available lender products based on the customer’s needs, which depend on inputs from the “Purpose Home Loan” and “Needs Analysis” modules.

Purpose Home Loan module

Is the property to live in? (“Live in” or “investment”)

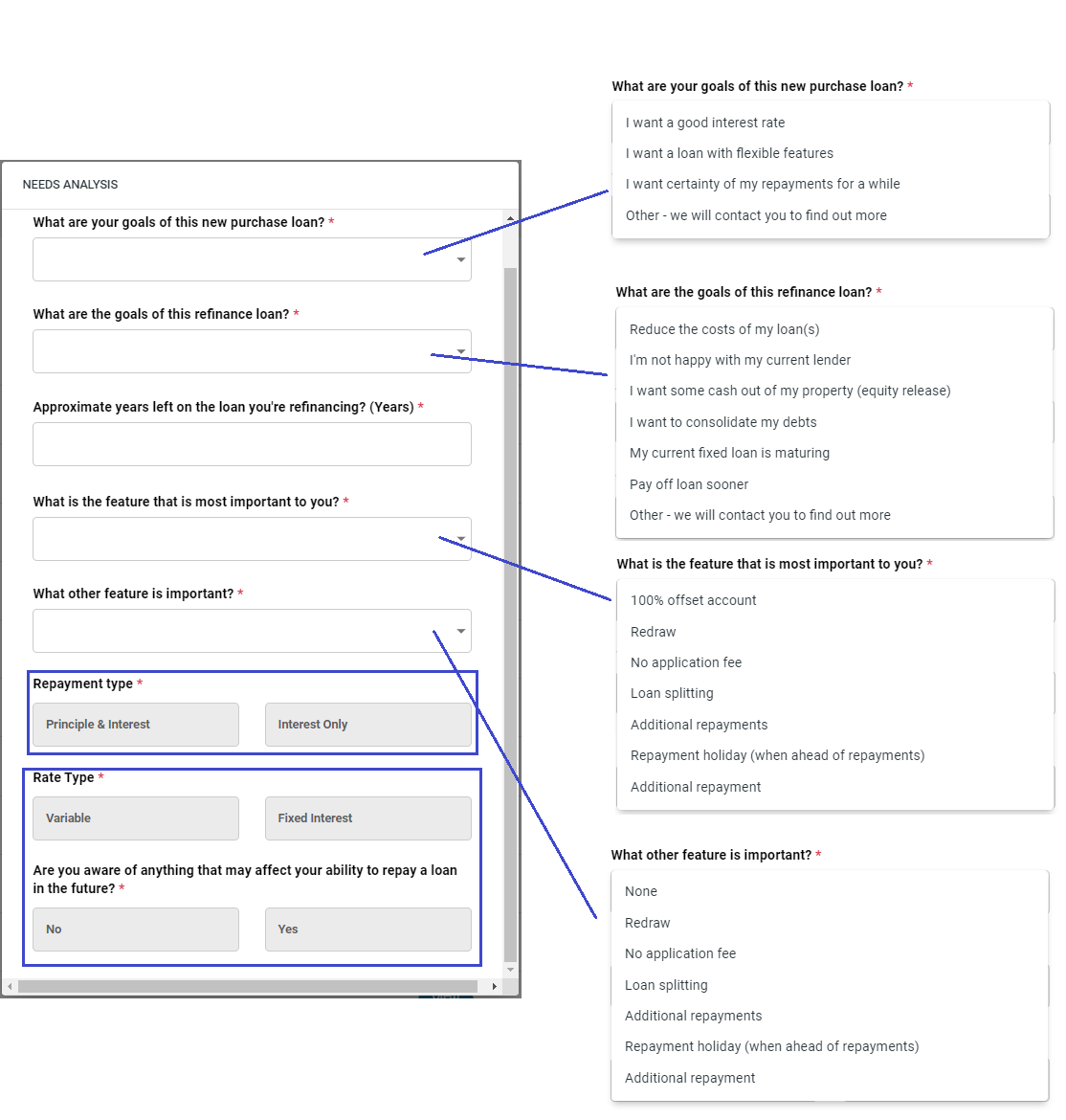

Needs Analysis module

“What is the feature that is most important to you?”

“What other feature is important?”

These questions are asked to be in complaince with responsible lending (RG 209) reasonable inquiries about a consumer’s financial situation, and their requirements and objectives

These questions are in compliance with the responsible lending (RG 209) guidelines that require reasonable inquiries into a customer’s financial situation, needs, and objectives. It also necessitates verifying the customer’s financial situation, making a preliminary or final assessment of whether the credit contract is “not unsuitable” for the customer, and providing the consumer with a written copy of the assessment upon request.

To display the products that meet the customer’s requirements, both Needs Analysis module questions must be answered.

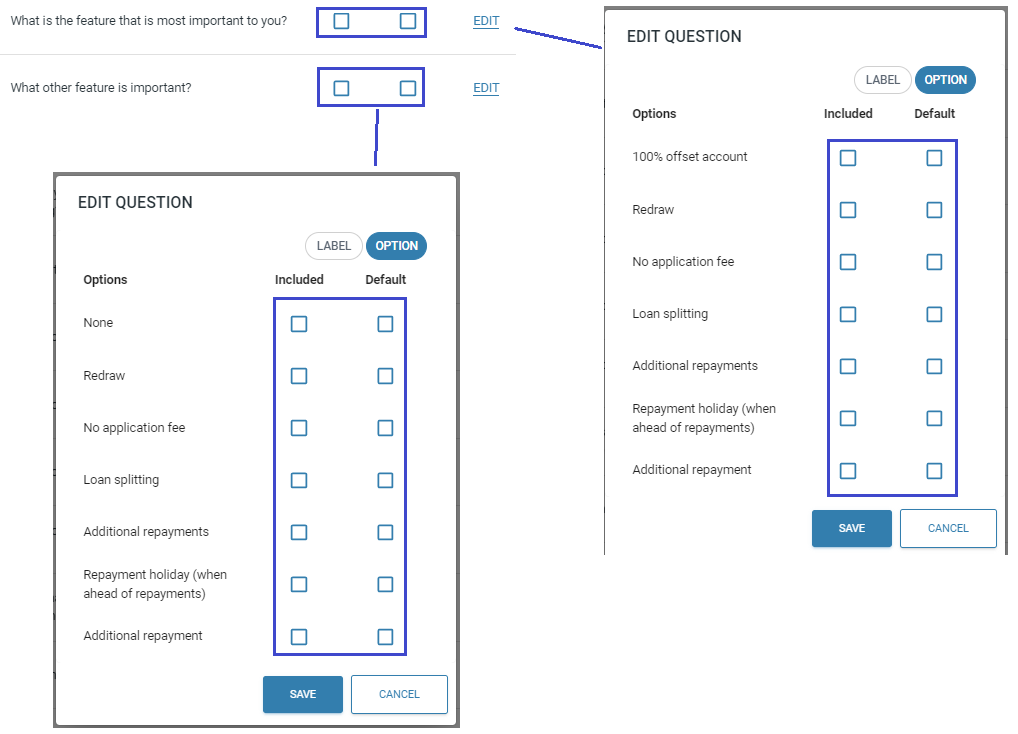

No Features

If a product has no relevant features, you can deselect the two questions from the Needs Analysis module, including all menu options within the question by clicking “Edit” – Figure 2.

If a product has no features, having any boxes checked may prevent the display of products on the product select page

Purpose Home Loan/Personal Loan – refers to declaring the various purposes such as purchasing a new property/vehicle or refinancing an existing one.

Needs Analysis – determines the customer’s specific requirements. Based on the information provided, the lender matches the customer’s needs to the appropriate products and displays the most suitable options for the customer to review.

Product selection – matches the lender products to the needs the customer has delcared and displays the most suitable products to their requested neededs for them to review.

Customer details – customer details are collected

Digital ID – customer is provided a link verify their identity digitally.

Collect Bank Statement – Bank transactions and details are retrieved to automatically populate the customer’s income, assets, and liabilities.

Income Employment – The customer has the option to enter their primary employment details manually if the details were not automatically populated via the “Collect Bank Statement” stage.

Income Other – The customer can manually enter any other sources of income they have.

Expenses – Living expenses are automatically sourced and categorised using the “Collect Bank Statements” feature. However, the customer can declare any changes in their expenses after loan settlement, such as if they purchase a principal home and will no longer be paying rent.

Financial position – The summary of the customer’s Assets and Liabilities is displayed, and any missing details are highlighted before proceeding to the signing declaration page.

Review and Submit section allows the customer to review, declare, provide consent, and sign their application form.

Figure 1

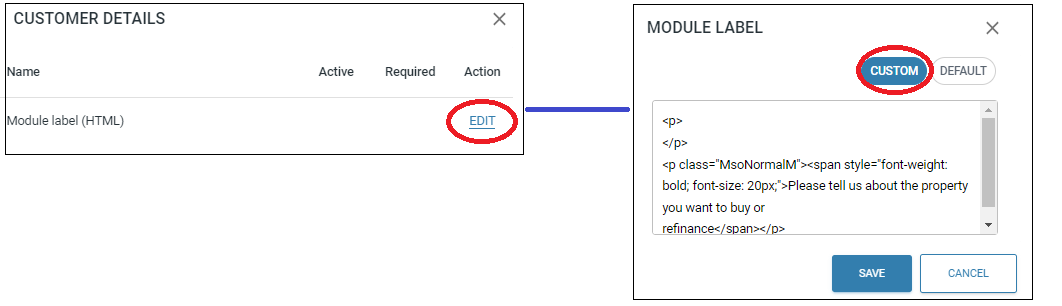

Figure 2

Module labels

Additionally, there is an option to change a module lable in a form by either adding plain text that will be presented as ‘Paragraph text’ or include an HTML code containing style, branding and images.