Home »

Product Tab

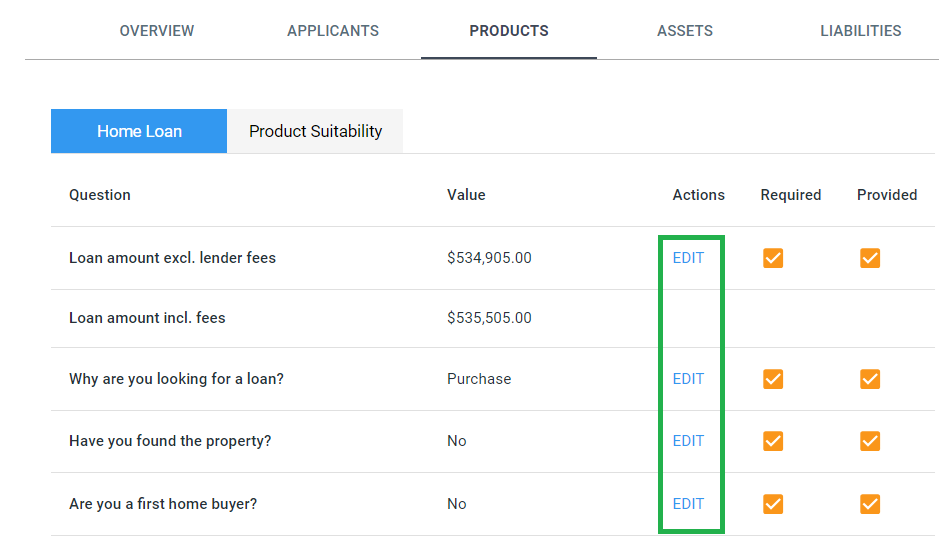

The product tab displays the application loan and product details including the ability to change the product, discount interest rates and waive fees.

You can edit the application form by clicking on ‘Edit’. This will open a pop-up window showing the details that the customer entered during the application process, enabling you to amend the selected options.

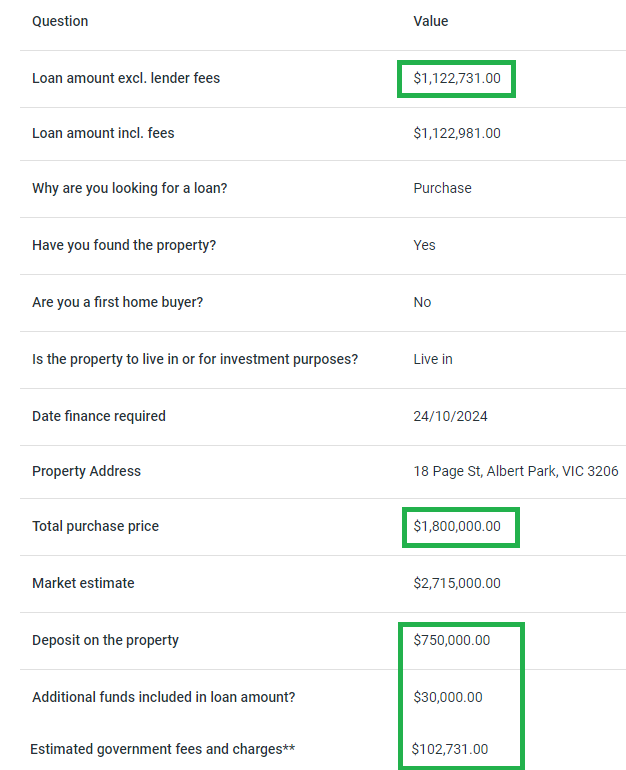

Loan Amount (purchase)

The loan amount, excluding lender fees for purchase, is automatically calculated using the following funds position formula:

(Total purchase price + Estimated government fees and charges) – (Deposit on the property + Additional funds included in the loan amount)

For example: £1,800,000.00 + £102,731.00 – £750,000.00 + £30,000.00 = £1,122,731.00

Loan amount, including fees = £1,122,731.00 + All fees

Note: When the purchase price is amended, the government costs (e.g., stamp duty) are updated accordingly.

Note: The loan amount can also be amended manually, though this is not recommended.

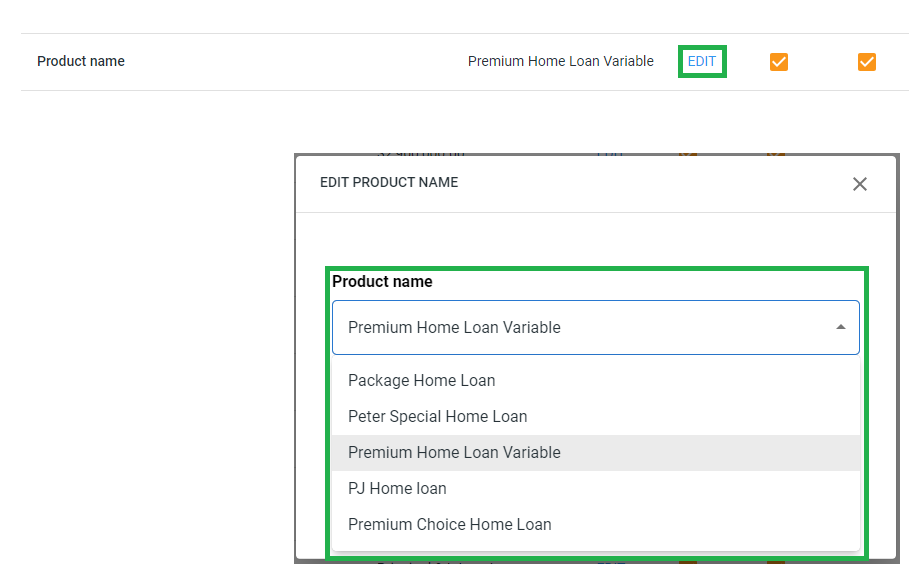

Product Selection.

After the application has been submitted, the product type can be amended under the Product Name field. To do this, click the Edit button, which opens a dropdown displaying all products available within the product category.

When a product is changed to a new product type, the interest rate, comparison rate, and fees will be updated accordingly.

Rates and fees can be updated to reflect waivers or discounts. (A change log will be recorded if this occurs.)

Based on the Rate Type and Repayment Type selected, further fields will be displayed for confirmation, including Fixed Terms and Interest-Only Periods.

Note: You will only be able to select products that match the product criteria or parameters (e.g., LVR, loan amount, etc.; please refer to your product matrix).

Purchase, Refianace, Settlement Dates

Entering a date in the date field is essential for reporting and is also vital if the merchant is using Ultracs for their core banking, as this date is mandatory for calculating loan repayments based on Ultracs’ unique repayment formula.

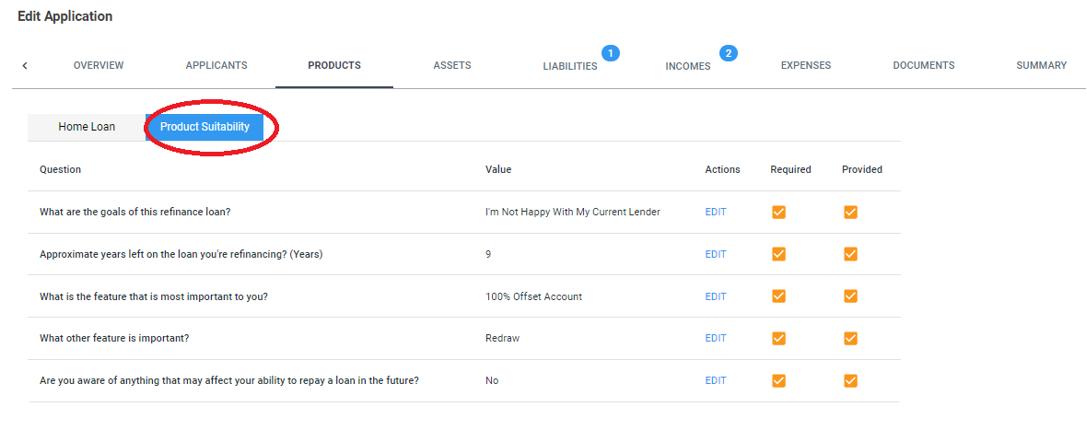

Product Suitability tab

The “Product Suitability “sub tab below refers to the Responsible lending (RG 209) question set.

The responsible lending obligations involve:

- making reasonable inquiries about a consumer’s financial situation, and their requirements and objectives

- taking reasonable steps to verify a consumer’s financial situation.

- making a preliminary assessment (if you are providing credit assistance) or final assessment (if you are the credit provider) about whether the credit contract is ‘not unsuitable’ for the consumer