Home »

Serviceability

Loan serviceability provides the details of the customer income position based on the assessment pipeline ruleset.

This includes:

- Income/s

- Liability Expenses

- Living Expenses

For the serviceability to function correctly, the following required items must be included via the assessment pipeline ruleset.

PAYG Income

Income uses the most current ATO tax brackets to work out the net income.

We do include the Medicare levy of 2%

We do not include the LTO (Low Income Tax Offset)

Gross only.

Formula – uses the ATO tax brackets to work out the net income.

Example – $100,000 gross p.a. = $75,033 net p.a.

Additional Income – overtime, commissions etc.

Formula- adds the additional income on top of the PAYG gross income and applies the tax brackets, then applies the shading if any then displays the end result.

Example:

PAYG = $100,000 gross p.a.

Overtime = $10,000 gross p.a.

PAYG – $100,000 gross p.a. = $75,033 net p.a.

PAYG w/overtime $110,000 gross p.a. = $81,583 net p.a. = $6,550 net p.a. x Shading if applicable (80%) = $5,240 p.a.

$100,000 gross – $110,000 gross = $10,000 gross

$81,583 net – $75,033 net = $6,550 net p.a.

NIMO displays: (annual or monthly)

Base Gross Income – $100,000 p.a.

Base Net Income – $75,033 p.a.

Additional Gross Income – $10,000 p.a.

Additional Net Income – $6,550 p.a.

Additional % – 80% (if appliable)

Additional % Gross Income – $8,000 p.a.

Additional % Net Income – $5,240 p.a.

Formula –

Credit & Store Cards

Liability Limit

Liability Limit %

Adjusted Repayment

Formula – Liability Limit x Liability Limit % = xxx

Example – $1,000 Limit x 3% = $30 repayments

Income

Base Gross Income

Base Net Income

Additional Gross Income

Additional Net Income

Additional %

Additional % Gross Income

Additional % Net Income

Loan Expense

Liability Amount

Payment Amount with Buffer

Evaluation Percentage

Income/s

- Income employment: refers to the primary income source of the customer.

- Additional income: refers to bonuses, commissions, and other earnings that a customer can receive throughout the year. This type of income can be weighted within the assessment pipeline ruleset.

- Other income: refers to other sources of income such as rental income, family allowances, etc. This type of income can also be weighted accordingly based on credit policy via the assessment pipeline ruleset under “Other Income.”

Liability Expenses

Liabilities can be calculated in one of two ways:

- Evaluation percentage: calculates the repayments at a certain percentage, such as $1,000 repayments at an evaluation percentage of 100% = $1,000 and 80% evaluation percentage is $800. This method is predominantly used for personal loans, vehicle loans, etc.

- Percentage buffers: calculate the repayments with a percentage buffered added. For example, if the loan interest is 4% and the buffer is 3%, then the serviceability repayment will be based on 7%. There is also an option to add a floor limit buffer, which is the minimum or lowest interest rate that will apply. If the actual/declared interest rate + buffer is lower than the floor rate, then the floor interest rate will be used to calculate the repayments.

Living Expenses

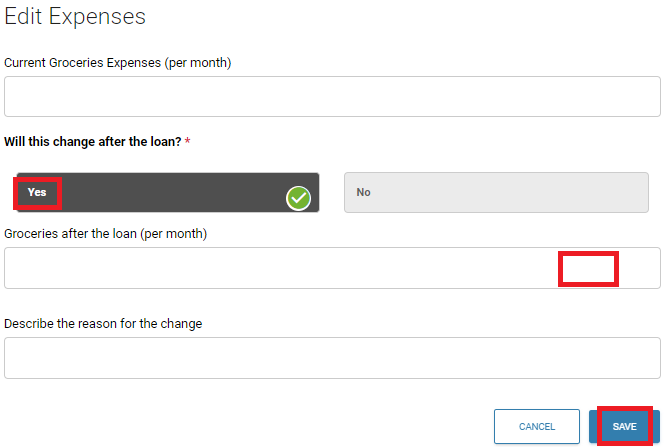

Traditionally, this data is retrieved automatically via the customer’s bank statements. However, if the customer chooses to update the living expense categories manually, they have the option to do so.

The living expenses categories also allow the customer to change the expenses per category if they anticipate a change in their expenses after loan settlement. For example, a first home buyer may have been paying rent before purchasing their first home. However, after settling their loan and moving in, they will no longer be paying rent. In this case, they can select “yes” to the question “Will this change after the loan?” and enter the new amount as $0. They can also provide a reason, such as “bought new property to live in.”